This week some of team Snobal are in the City of Angels at a client kickoff event. The theme? Digital transformation.

It’s timely as this week global management consulting company McKinsey & Company’s annual Global Banking Reviews came out and it sounded a death knell for traditional banks.

According to McKinsey & Co. nearly 60% of the world’s banks may not be “economically viable” because their returns aren’t keeping pace with costs and that banks must innovate or risk “becoming footnotes to history”.

Innovation archetypes?

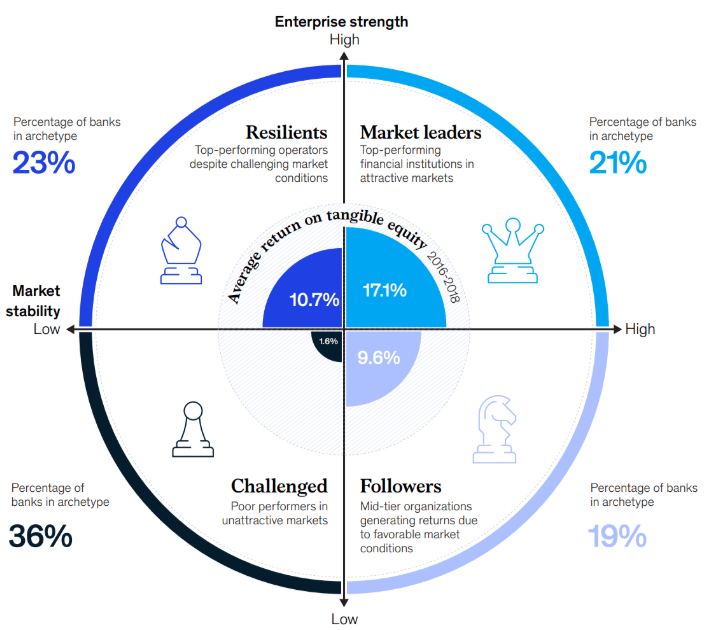

The report divides banks into four banking archetypes or categories and the responses they should take to these broader market forces:

- Market leaders (reinvest capital in innovation and scale);

- Resilients (focus on expanding customer base and product offerings and differentiating through innovation);

- Followers (act quickly to achieve scale, cut costs and transform business models);and;

- Challenged (merge with similar banks or find a buyer).

Lessons for construction industry

Banking like agriculture and construction is one of the oldest industries and has been around in one form or other since ancient Greece, Rome, Egypt, and Babylon. And yet here it is, according to McKinsey & Co. an industry in turmoil. Changing consumer behaviours, digital disruption and a growing number of players and products all seen as playing a key role.

When we study disruption across industries, there are always clear stages to the lifecycle of a typical attack—from faint signals of experimentation to validated business models to critical mass or at-scale plays. And repeatedly, the reason many incumbents fail, irrespective of their strong ingoing balance sheet and market share, is because of their inability to acknowledge a trend.

According to the report, digital disruption is now occurring at pace, [pp11] and banks need a plan of response. And one of the biggest challenges for traditional banks is the need to invest in overhauling operating models in order to be able to compete with digital offerings. As the report says the amt traditional banks spend on research and development (R&D) is telling when compared to digital disruptors:

while fintechs devote more than 70 percent of their budget to launching and scaling up innovative solutions, banks end up spending just 35 percent of their budget on innovation with the rest spent on legacy architecture.

This finding is as reflected in the recent Benchmarking Innovation Impact 2020 report, sponsored by KPMG, which found companies are allocating more resources to developing and scaling more ambitious and transformational business models and services.

It is a challenging and volatile time for all industries and it shows no signs of abating. It requires as the report says nothing short of some bold moves.

You can read KPMG’s report here and McKinsey’s annual Global Banking Reviews here.